LESSON 19: WHY THE PURCHASING POWER IS NOT MAINTAINED

We have seen how, under a Price System, the rate of flow of money from the consumer to the retailer of goods and services acts as an industrial control mechanism. We have found that if individuals and corporations be allowed to save, the requisite purchasing power to buy the existing products of industry can only be maintained provided money is being paid back to the consumer through the construction of new plant or other capital goods, at a rate equal to that at which money is being lifted from the purchasing power for consumers’ goods through individual and corporate savings.

The Inevitable Inflection Point. At first thought, from this simple consideration, it would appear that our physical production should expand indefinitely until blocked either by a physical limitation of the ability to produce or by a saturation of our ability to consume. The fact remains, however, that the inflection point of our industrial growth curve occurred sometime around 1915, and since that time, as we have pointed out elsewhere, industrial production has been leveling off. That this leveling off was not due to an inability to increase production is to be seen when one considers the fact that in 1929, the year of an all-time peak of physical production, little if any of our productive equipment operated with a load factor of more than 331/3 percent.

What we mean by load factor is the ratio of the actual production divided by productive capacity at continuous 24-hour-per-day full load operation.

Among the most continuously operated parts of our industrial equipment are the electric power system and the telephone system. The load factor on the power system in any but special branches rarely equals 40 percent of its productive capacity. The load factor on telephones is much lower than this. Most of our other industrial equipment in 1929 operated only one or two shifts per day for a limited number of days per year.

It has become customary in discussing present rates of industrial operation to compare them with the 1929 rate, and refer to the latter as being our ‘industrial capacity’. Consideration of load factors shows quite conclusively that such was far from the case, the Brookings Institution, and other professional apologists for our status quo notwithstanding.

Attempts to Maintain Production. The increasing deficiency of purchasing power for the purpose of buying our potential production is brought out by other corroborative facts. During the World War for the first time we found ourselves playing a significant role in world trade. This was affected through the mechanism of loans to foreign countries enabling them to buy our surplus products without our having to accept a corresponding amount of theirs in return. Due to the fact that our domestic purchasing power after the war was not sufficient to buy goods at the rate, we were able to produce them, we tried to continue this method of getting rid of surplus goods by making still further foreign loans, and by preventing our own people from buying from abroad by building a tariff barrier so high as to make importation of foreign goods practically impossible. The fact that these loans could never be repaid while maintaining a ‘favorable balance of trade’ and that this amounts to a net physical loss to the country is, of course, well known. Yet such practices are not only in accord with the canons of ‘good business’; they are dictated by the necessities of business expediency.

The significant aspect of this is that America’s capacity to produce was during all this period in excess of the American public’s capacity to buy, so that a surplus margin of production was maintained by promoting what amounted to installment selling abroad.

According to Mr. George W. Peek, in his report of May 23, 1934, to the President, the net increase of this debt owed to us by foreign countries for the period July 1914, to July 1922, was $19,305,000,000. For the corresponding period from 1923 to 1929, this debt was further increased by an amount of $2,572,000,000.

Since the American productive capacity was still in excess of the ability of the American public to buy, plus the installment selling abroad, a further increase of production was achieved through the mechanism of installment selling at home. In this process the debt built up by installment buying during the period from 1924 to 1929 amounted to $9,000,000,000, or approximately $2,000,000,000 per annum net increase.

The significance of this is that effective purchasing power, that is to say, purchasing power that was actually being used to purchase goods and services, and hence to keep industry operating, was falling further and further behind the ability to produce. Therefore, the rate of operation actually was maintained through the device of selling abroad some 22 billion dollars’ worth of goods more than could be paid for, while at home in the latter part of this period at least 9 billion dollars’ worth of goods in excess of current purchasing power were sold. Had this not been done our industrial production would, of course, have leveled off faster than it did.

The Financial Structure. The question that all this leads us to is why was not the effective purchasing power sufficient? Why did it not keep pace with productive capacity? If savings are used to build new plants, do they not then become wages and salaries of the workmen, and hence feed right back into the effective purchasing power? This would have been true a century ago in the days of hard money; today, however, money no longer conforms to this simple picture. The total amount of hard money in existence in the United States in 1931 was only about 5 billion dollars. The amount of money represented by gold bullion, metallic coins, bank notes and United States currency totaled only a little over 9 billion dollars. When it is considered that in 1933 the total of all long and short-term debts, including money, amounted to 238 billion dollars, it becomes immediately evident how relatively insignificant the small amount of actual cash in existence is in such a picture.

The Process of Investment. The simple fact is that, when individuals and corporations save through the process of reinvesting, these savings are not, as naively supposed above, spent except in a small part in further plant construction. The greater part of all investments in this country since the year 1900, have gone into pure paper, without there having been a plant expansion commensurate with the amount of money invested.

The history of almost any great American corporation will bear this out. Most American industrial establishments which have since grown into positions of national consequence began in a small way under individual or partnership ownership; or else, like some of the earlier railroads as joint stock companies, the shares of which were sold directly to the public without their having been even listed on the Stock Exchange. Profits were plowed back into the business, and the plant expanded under its own savings. Debts were contracted, if at all, usually by short-term loans from the banks. Except in the case of the joint stock companies, ownership was maintained by a single family or by a small number of partners. In these formative stages, securities speculation was a practice little indulged in, and the money obtained from the sale of securities was practically all used to expand the plant.

It has been the usual history in such cases that after the industry in question was well established, bankers and promoters became interested. Through their services reorganizations or mergers have been effected. Bonds and preferred stocks have been issued to the former owners and to banking groups interested in the reorganization, usually in amounts greatly in excess of the original capital investment. Over and above this, common stock has been issued, usually in an amount similar to that of the bonds and preferred stocks. These common stocks, however, have not been in general marketed by the corporation for the purpose of raising additional capital funds. They have, instead, been given away in the form of bonuses to bankers, promoters, and other interested insiders, or else issued as stock dividends for no monetary consideration whatsoever, and hence no addition to the plant. These stocks are in turn fed into the Stock Exchange by these interested insiders, until they are finally bought up by the investing American public. It is to be emphasized that the proceeds of such sales of common stock go to the insiders, and not to the corporations or into new plant.

A similar paper manipulation has been carried on in bonds and mortgages through the mechanism of the holding company. In this manner the paper of an operating company is used as security for issuing other paper of, say, a holding company, and this in turn re-hypothecated until several generations of stocks and bonds are issued and sold to an unsuspecting investing public, all with no backing whatsoever other than that of the original inadequate plant on which the first stocks and bonds were issued. In many cases such bonds are still in existence long after the equipment securing them has ceased to exist.

When one considers that such manipulations as these are the accepted methods of sound finance it begins to be evident why the money reinvested in industry does not become available in a corresponding amount as further purchasing power.

If it happens that new plant is built at a sufficient rate to supply the deficit in purchasing power all is well and good, but there is no necessary reason why this should be so. The great bulk of savings, both individual and corporate, are reinvested. Investment, we now see, consists in buying pieces of paper labeled usually as stocks or bonds. If the money spent for these pieces of paper were used to build a new plant this money would, in the manner we have already indicated, be largely paid out to workmen, and hence become effective purchasing power. If, however, the securities purchased represent, as is usually the case, merely paper floated by interested insiders upon a plant already in existence, this does not increase the productive plant, and thereby augment small incomes; it becomes, instead, the medium of debt creation held by the bankers and promoters, and its interest or dividends goes to further increase a small number of individual incomes which, in most cases, are already overwhelmingly large.

Income. The net result of this kind of procedure is to produce an ever increasing disparity in the distribution of the national income. This disparity is well brought out by the Brookings Institution Report on America’s Capacity to Consume, published in 1934. According to this report, in 1929 there were 27,474,000 families in the United States receiving an aggregate income of $77,116,000,000. Of these, 24,000,000 families, or 87 percent of the total number of families received incomes of less than $4,000 per annum, constituting only 51 percent of the total income. According to this report:

‘Nearly 6 million families, or more than 21 percent of the total, had incomes less than $1,000.

‘Only a little over 12 million families, or 42 percent, had incomes less than $1,500.

‘Nearly 20 million families, or 71 percent, had incomes less than $2,500.

‘Only a little over 2 million families, or 8 percent, had in comes in excess of $5,000.

‘About 600,000 families, or 2.3 percent, had incomes in excess of $10,000.’

And further:

‘The 11,653,000 families with incomes of less than $1,500 received a total of about 10 billion dollars. At the other extreme, the 36,000 families having incomes in excess of $75,000 possessed an aggregate income of 9.8 billion dollars. Thus, it appears that 0.1 percent of the families at the top received practically as much as 42 percent of the families at the bottom of the scale.’

These facts clearly show that the great bulk of the families receive incomes far below their physical capacity to consume, while a large part of the income goes to only a handful of people, and in an amount far in excess of their ability to consume. Bearing in mind that consumption is a physical operation, and that there are definite physical limits to how much food, clothing, etc., a single individual can consume, it follows that the great bulk of the consuming must, because of their preponderance in numbers, be done by those people with small incomes. The small number of people with the large incomes can account for only a small fraction of the total physical consumption. It is true that they build expensive houses in the suburbs, purchase rare and therefore expensive paintings, and indulge in various forms of conspicuous consumption. Still the fact remains that the amount of coal, gasoline, food, clothing, etc., that is actually consumed by a family with a million dollar per year income, is not at all commensurable with the magnitude of the income. While it is true that such families may employ a large coterie of servants, we must not lose sight of the fact that the money paid to these servants is their income, and that the consumption for which they are responsible cannot be credited to the millionaire family which employs them. Due to the impossibility of spending even in conspicuous consumption the total of such large incomes, it follows that it is these which are likely to be the source of the greatest savings. This presumption is verified again by the Brookings Institution Report, according to which the aggregate saving of families of 1929 amounted to $15,139,000,000. Of this, 34 percent was derived from the 24,000 incomes above $100,000; 67 percent of these aggregate savings was accounted for from the 631,000 families with incomes above $10,000 per year.

In other words, the bulk of the consuming is done by people having less income than $10,000 per year; the bulk of the saving by those having incomes greater than $10,000 per year.

What is significant about all this is that industry, as we have remarked before, is geared to the rate at which people spend money for consumable goods. Now, it becomes evident that almost all of this money that is spent for consumable goods is accounted for by those people whose incomes are far below their physical capacity to consume. These small incomes are in turn derived almost entirely from wages and salaries or from agriculture. The wages and salaries paid by industry are determined on a value basis in which human beings compete with machines.

Profits, Technology, and Purchasing Power. An individual businessman is in business for the purpose of making money. If his particular business happens to be the operation of, say, a factory, he finds that there are two principal ways by which his profits can be increased. Other things being considered for the moment constant, he finds that his total profits can be increased by increasing his sales and hence the production of his product. The other way in which profits can be increased is by the lowering of the internal cost of production. It is a simple physical fact that a human being at his best can only do work at the rate of about one-tenth of a horsepower (one-tenth h.p. equals one-thirteenth kw.). Human beings at the lowest sweatshop rates cannot be paid much less than 25 cents per hour. Mechanical power, on the other hand, is produced at the rate of one kilowatt hour per pound and a half of coal and can be retailed at an industrial rate of about 1 cent per kw. hr. Thus, it will readily be seen that when man-hours sell at 25 cents or more each, while kilowatt-hours can be purchased at an industrial rate of 1 or a few cents each, and when it is further considered that the kilowatt-hour will do 13 to 100 times as much work as a man-hour, and do it faster and better without any attendant labor troubles, it becomes evident that man-hours have slight chance to survive. Thus, one of the most effective ways of reducing internal costs is to substitute kilowatt-hours for man-hours.

We now see that almost the complete controlling mechanism of industrial production is the rate of expenditure of small wages and salaries. If the sum of small wages and salaries in a given year is 50 billion dollars, then industrial production for that year is only slightly more than 50 billion dollars, because small wages and salaries are almost entirely spent for goods and services, and the large incomes accrue to such a small percent of the total population that they account for a relatively unimportant fraction of the total consumption.

Since one of the fundamental rules of the Price System is that only through the acquisition of purchasing power can the individual subsist, it follows that as the only means of acquisition open to the majority is employment, then he who does not work does not eat. Collectively speaking, salaries and wages are directly proportional to the total man-hours required to operate the social system. Employment, as we have seen elsewhere, depends both upon the quantity of production and upon the man-hours required per unit produced. This process, we know already, is one in which total production is leveling and the man-hours per unit produced are continually falling.

In the earlier stages of such a process, production, while still increasing, falls further and further behind the plant’s capacity to produce, because the wages and small salaries form a declining fraction of the retail price of the goods produced. This curtailment of production below the capacity of the existing plant tends to discourage the building of new plant. If, for instance, the capacity of existing shoe factories were 900 million pairs of shoes per year when the public was only buying shoes at the rate of 400 million pairs per year, this would lead to a curtailment in the rate of building new shoe factories. This same sort of thing is true for any other branch of productive industry. Since a large part of the wages and small salaries are derived from the construction of new plant, this curtailment of the capital industry results in a further reduction of wages and salaries, and leads to a corresponding decline of purchasing, and hence of the production of consumers’ goods. Once this decline sets in, it is self-accelerating downward unless counteracted by means more or less foreign to the industrial process itself.

New Industry. Of the factors which are supposed to counteract the process we have just described; one is the growth of new industry. Let us consider such a case. Specifically, what we want to know is, if present industry is not providing enough purchasing power to enable the public to buy its products when running at capacity, will a new industry make the situation better or worse?

Suppose that a plant manufacturing a completely new product is built. Suppose the plant cost $1,000,000. Most of this $1,000,000 goes to wages and salaries of the people who built it, and thus increases purchasing power with which to buy the products of the existing plant. Now let the new plant start operation and let the retail value of its products be $10,000,000 per year. Suppose that only $4,000,000 per annum of this is spent for wages and small salaries. Then one would have a situation where $10,000,000 worth of new products are added to those which the public is expected to buy per year, but the consuming public—those receiving wages and small salaries—will only have been given $4,000,000 with which to buy the products. The other $6,000,000, if the product is sold, will all accrue to a small number of people in the large income brackets. If production is to be balanced, this small number of people must consume the $6,000,000 worth of products. The observed fact is that in general they do not and cannot. If, therefore, the whole production is to be disposed of, the money to buy it must be derived in part from the already deficient purchasing power accruing from the older branches of industry.

This sort of relationship was not true in the earlier days of industry, because at that time employment was increasing as production increased, and small incomes comprised the greater part of the cost of production. This enabled the public to buy back the goods produced and yielded a purchasing power which expanded as the productive capacity expanded. The same technological factors that have enabled us to produce more goods with fewer men, have at the same time, rendered it impossible to sell the goods after they are produced. In the earlier days, new industry provided the deficit in purchasing power for current production, and at that time we could look forward to industrial growth with a corresponding prosperity; today we can look forward to neither.

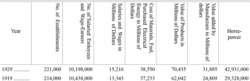

This trend is well exemplified in the following table taken from the Abstract of the U.S. Census, 1932.

TABLE 8

In this table comparative figures are given on the whole manufacturing industry of the whole United States for the years 1914, 1919 and 1929. The year 1914 is a normal pre-war year, 1919 is the year of the peak of war-time production, 1929 is the year of all-time peak production. It is interesting to note that the number of establishments rose from 177,000 in 1914 to a peak of 214,000 in 1919, and then declined to 211,000 in 1929. The production for each one of those years was greater than the year preceding.

In a similar manner the total number of salaried employees and wage earners in industry rose from 7,589,000 in 1914 to an all-time peak of 10,438,000 in 1919, and then declined to 10,198,000 in 1929. The horsepower, however, rose continuously from over 22,000,000 in 1914 to more than 29,000,000 in 1919, and nearly 43,000,000 in 1929. Thus from 1919 to 1929 production was increasing, horsepower was increasing, and man-hours were decreasing.

For these same years, the value of the products added by manufacture was approximately 10 billion dollars in 1914, 25 billion dollars in 1919, and 32 billion dollars in 1929. The amount paid out in wages and salaries for the same respective years was approximately 5 billion dollars, 13 billion dollars, and 15 billion dollars. The difference between these—the value added by manufacture minus the amount paid out in wages and salaries—gives us the remaining amount which goes to pay rent, interest, fixed charges, and profits.

This remainder, therefore, goes largely to augment big incomes. It is significant that this latter amount rose from 4.4 billion dollars in 1914 to 11.5 billion dollars in 1919, and 16.7 billion dollars in 1929. Thus from 1914 to 1919, while the small income proceeds of industry were rising by an amount of 8.0 billion dollars, the large income proceeds rose 6.1 billion dollars; and from 1919 to 1929 the large income proceeds rose 5.2 billion dollars, while the small income proceeds —wages and salaries—rose only 1.9 billion dollars.

Debt Creation. We have already mentioned that this growing disparity between effective purchasing power and plant capacity leads first to a decline in the rate of increase of production, and next to an absolute peak followed by a decline in production. It follows that the only way this trend of events can be temporarily retarded is through the process of debt creation. When the public has not the requisite purchasing power, we grant it a fictitious purchasing power through the mechanism of installment buying. We find also that by a similar device applied abroad we can promote foreign trade and can ship away our goods and receive debts in exchange. Also, through the mechanism of securities speculation and other forms of paper manipulations, we have multiplied our millionaires. They, in turn, allow a small part of their incomes to trickle back to the marketplace through the medium of servants, and other forms of ostentatious living.

Simple considerations will show that the debt process of balancing our national economy cannot long endure, for the fundamental property of debt, upon the validity of which all our financial institutions—banks, insurance companies, endowed institutions, etc.—rest, is that the debt structure is expected to expand at a compound rate of increment per annum. To maintain a 5 percent per annum rate of expansion on our debt structure, and have it bear any fixed relation to physical production, or, in other words, to maintain a constant price level in the meantime, would require that industry expand at a corresponding rate.

As we have seen, during the period from the Civil War till the World War, American industry did expand at such a rate as to double its production every 12 years—a rate of growth of 7 percent per annum. During that period, the monetary interest rate remained approximately stationary at about 7 percent per annum and our financial institutions were ‘sound.’ Since the decade of the World War industrial production has been leveling off and its rate of growth declining. In this situation the debt structure can do either of two things (or a combination of the two): (1) The interest rate can be kept constant; in which case the debt structure will expand faster than the industrial production and the ratio between debt and physical goods will continuously increase. This is pure paper inflation and leads to a corresponding increase in the price level or to a continuous decline in the amount of physical goods that can be purchased each year from the return of each dollar invested, which is, in effect, a decline in the interest rate. (2) The price level may remain stationary. In this case inflation is precluded so that the rate of increase of the debt structure must be held approximately equal to the mean secular rate of growth of production. This leads directly to a decline in the nominal rate of interest.

These deductions concerning the decline of the interest rate that must accompany the decline in the rate of industrial expansion are amply confirmed by the events since the year 1920. During that time, the mean secular rate in industrial growth has been steadily decreasing. Accompanying this interest rate throughout that period has also been declining continuously until today the interest rates are the lowest in the last hundred years. Since there is no reason to expect more than temporary periods of future industrial expansion, there is no reason to expect any other than temporary reversals of this downward trend of the interest rate. Yet an interest rate approaching zero undermines completely our complex of financial institutions, because these depend upon a finite interest rate for their existence.

All of this series of events which we have been discussing more or less hypothetically is what has actually been happening in the United States since the World War. From the World War to the stock market crash in 1929, the deficit of purchasing power that had to be met to maintain an increasing industrial production was derived largely through the mechanism of private debt expansion at home and abroad. After the stock market crash, with the resulting standing army of 15 to 17 million unemployed, and an industrial production of approximately 50 percent of that of 1929, it became necessary in order to maintain the Price System, for the government to assume the debt creation function.

This is being accomplished by the Federal Government’s borrowing about 4 billion dollars per annum more than its current income, and donating this under one pretense or another to the public to make up, partially, the deficit resulting from so called normal business activity. A similar, though perhaps smaller, debt expansion is being carried on by state and local governments, many of which are dangerously near bankruptcy at the present time. In the meantime, the banks belonging to the Federal Reserve System are reported in the newspapers as holding the highest surplus in history, and the United States Government itself has become the most profitable field for investment.

Thus, America finds herself today in the position where private corporate enterprise has practically ceased to exercise the prerogative of creating debt and has voluntarily surrendered this prerogative to the Federal Government of these United States; so much so that the Federal Government has at this time become practically the sole creator of debt claims in large volumes for the sole purpose of sustaining the debt structure of this Price System by further Federal, debt creation for the benefit of the majority holders of debt claims, chiefly of private enterprise. Or, as Howard Scott has aptly remarked, ‘When American businessmen find it no longer profitable to indulge in further debt creation it is only just and meet that their government should do it for them.’

In spite of all this so-called ‘priming of the pump’ by government expenditures, industrial production is still only slightly above the lowest point reached since 1929, unemployment is still variously estimated at from 10 to 12 million, relief figures are rapidly mounting to where, according to Relief Administrator Hopkins, there are now 19,500,000 people on Federal relief alone. By playing the game by the ‘Price System Rules’, there is no prospect in the future for the situation to do anything but get worse rather than better. And all this in the midst of potential plenty!

References:

- America’s Capacity to Consume, Leven, Moulton and Warburton.

- Security Speculation, Flynn.

- Theory of Business Enterprise, Veblen.

- The Engineers and the Price System, Veblen.

- Statistical Abstract of the U.S.

- The Economic Consequences of Power Production, Henderson.

- History of Great American Fortunes, Myer.

- Robber Barons, Josephson.

- Arms and the Man (Reprint from Fortune).

APPENDIX TO LESSON 19: POPULATION GROWTH IN THE U.S.A.

Not only has industrial growth followed the now familiar S-shaped curve, with a rapid rate of growth at first followed by a leveling-off process, but population, we shall now see, is doing the same thing.

The population in 1800 was a little over 5,000,000; by 1830 it had grown to nearly 13,000,000; by 1860 it was 31,000,000; by 1900 it was 76,000,000; by 1930 it had reached 123,000,000; and by 1938 it was 129,000,000 or 130,000,000. If the population as taken from the United States Census be plotted as a growth curve, it will be found that the total growth is still increasing, but that the rate of growth is decreasing. The annual increment to the total population in 1914 was approximately 1,800,000, while in 1934 the annual increment had declined to approximately 800,000. If the total growth curve be analyzed mathematically, it will be found that from 1790 until 1860 it was expanding at a compound rate of increment of about 3 percent per annum, and that since 1860 this rate of increment per annum has been steadily decreasing, until for the decade 1920-1930 it was only 1.5 percent.

This still does not tell us anything about how long the population may continue to expand, but we have an independent method of approach to this latter question by means of the birth rate and the death rate. The birth rate and the death rate are ordinarily stated in terms of the number of people being born or dying each year per 1,000 of the population. Thus, we find from the United States Census that the birth rate of the United States per 1,000 of the total population was 25 in 1915; by 1920 this had declined to 23.7; by 1930 to 18.9; and by 1936 to between 16 and 17 per 1,000. The death rate in the meantime has been almost stationary since 1920, at about 12 per 1,000. Now the present expectancy of life at birth in the United States is about 60 years.

It is obvious that if the number of people per 1,000 born each year is greater than the number of people per 1,000 that die each year, the population each year will become larger. If the number of people per 1,000 who are born each year is equal to the number of people per 1,000 who die each year, the population will neither increase nor decrease, but will remain stationary. Finally, if the number of people per 1,000 who die each year is greater than the number per 1,000 that are born, the population will decline.

It now remains to be seen what is the critical value of the birth rate above which the population will expand, and below which the population will decrease. In other words, if the average length of life is to be 60 years, how many people must be born each year to just maintain a stationary population? It would follow, of course, that once that state were attained the death rate would have to equal the birth rate. Under such a stationary state one-sixtieth of the population would die each year, and a like number would have to be born to make up this deficit. One sixtieth of 1,000 is 162/3; hence the critical value of the birth rate at which the population will cease to expand is 162/3 per 1,000.

Referring to the figures given above, it will be noted that our birth rate has just now reached approximately that critical number and with the increase of education and of birth control information as well as of economic insecurity, there is every reason to expect that the birth rate will continue to decline. The death rate in the meantime is still about 12, but as the present population gets older and begins to die off more rapidly, this rate should increase. It is expected, therefore, that the death rate will become equal to the birth rate not later than the decade 1950-1960, and possibly earlier. At this time, the population will cease to expand, and it will have a maximum number of probably not more than 135,000,000 people. Due to the fact that the birth rate will then be less than the critical number of 162/3, the death rate will become greater than the birth rate, and the population will begin to decline until it reaches some intermediate level at which it can become stabilized.

As the population approaches stabilization, the percentages of age divisions will shift. During the years of population growth, the larger percentages occurred in the younger age division; 40 percent were under 20 years of age, and about 20 percent were over 45 years in the year 1920. Assuming stabilization to be reached between 1950-60, it follows that the shift in population ages reached will be approximately 30 percent for those under 20 years of age, and those over 45 will be approximately 35 percent.

The above discussion is only a technical statement of fact. In discussions of this sort, it is not unusual for certain religious groups to become very despondent over the prospects of a cessation of population growth. Militarists frequently try to offset such a tendency (witness Mussolini and Hitler) because more population means more cannon-fodder. The people, however, in this country who are likely to be most concerned by a stationary population are our businessmen and our real estate promoters. As we have pointed out, our past prosperity has been intimately linked up with expansion of production, and the expansion of production has been aided in no small part by the growth of population. Every business was expected to expand, if for no other reason than that the population was expanding. Every roadside village, with few exceptions, could expect to be bigger ten years hence with a corresponding enhancement of real estate values and increase in the business of pioneer merchants of the place. Did not Marshall Field’s, in Chicago, for instance, owe its growth as a department store to the fact that Marshall Field got in on the ground floor while Chicago was little more than a village? What inconsequential village with an up-and-coming Chamber of Commerce does not dream of becoming a metropolis of tomorrow?

The levelling-off of the population growth curve merely means that this expectation will not be true for the future. After the population stabilizes, a gain in population by one town or city will only be at the expense of a corresponding loss of population by other areas. An increase in business by one organization will only be achieved by a corresponding loss of business to a competitor, or else by an absolute increase in the standard of living.

Let it be emphasized that all those who demand an increasing population have special interests, and their own private axes to grind. From the point of view of social well-being it is perfectly obvious that if the population is not stabilized before that time it will continue to expand until finally checked by the lack of the means of sustenance, with a standard of living comparable to that of India or China. On the other hand, if the population is too small there will not be enough people to properly man and operate a high-energy civilization. Between these two extremes there is an optimum population, and that optimum is probably about the size of our present population.

References:

- Statistical Abstract of the U.S.

- Population Trends in the United States, Thompson and Whelpton